PropNex Picks

|April 17,2025Property VS Stocks: Are You Investing In The Right Winner?

Share this article:

If you're serious about growing your wealth, you might want to consider skipping property... and diving into the stock market instead.

Yup - we said it.

With low entry costs, global diversification, and the ability to buy and sell in seconds, the stock market has become increasingly attractive to investors, especially the younger crowd. You don't need a six-figure sum to get started. No ABSD. No maintenance. Just a few clicks and you're in the game.

Compared to the hefty upfront costs and ever-tightening cooling measures in property, stocks seem like the obvious winner - right?

But before you start shifting all your funds into equities... Here's where things get interesting.

Stocks let you pivot quickly - but property lets you leverage. One moves fast. The other moves strong.

So which is better? It depends on you. Your goals. Your timeline. Your risk appetite.

The truth is, both can play a role in your wealth journey. The smart move isn't picking one over the other blindly - it's understanding how each works, and when they make sense for your unique situation.

Let's break them down - so you can make the right call.

What you'll learn in this article

By the end of this article, you'll have a clearer understanding of whether property or stocks is the right investment for you. Let's dive in!

Before weighing the pros and cons of property vs. stock investments in Singapore, it's key to understand what each involves.

Property investment means buying real estate (residential, commercial, or industrial) to gain through capital appreciation and rental income. It's a tangible asset seen as a "safe haven" by many Singaporeans, but it requires high upfront costs and faces restrictions like ABSD and loan limits.

Stock investment involves purchasing company shares to earn capital gains and dividends. Stocks are more liquid, accessible with lower capital, and offer diversification, but they're also more volatile due to market factors and economic shifts.

Now that we understand the basics of property and stock investment, let's compare them head-to-head based on the most important factors that influence returns, risks, and overall suitability.

1. How much do you need to start?

Property: Requires a large upfront capital due to

25% downpayment

ABSD for second and subsequent properties (up to 30% for Singapore Citizens, up to 35% for Singapore Permanent Residents, and 60% for foreigners)

Legal fees, maintenance, and property taxes

Stocks: Can start with as little as a couple of hundreds

No hefty upfront costs - just a brokerage account and an initial investment

No taxes on capital gains or dividends in Singapore

Verdict: Stocks win for accessibility. Property requires substantial capital, making it harder for younger investors to enter the market.

2. How easily can you cash out?

Property: Low liquidity - selling takes time due to

Market conditions, valuation checks, and buyer demand

Additional Seller's Stamp Duty (SSD) if sold within 3 years

High transaction costs (agent fees, legal fees, etc.)

Stocks: Highly liquid - you can buy or sell in seconds

Can react quickly to market conditions

No restrictions on selling anytime

However, do factor in brokerage fees and platform charges, which may vary depending on the provider

Verdict: Stocks win for liquidity. If you need quick access to cash, stocks are a better choice than property.

3. Which investment is more stable?

Property: Generally more stable, with prices fluctuating over longer periods rather than daily swings

Property values historically appreciated over time, and in Singapore context, they have shown a strong long-term growth trend - supported by prudent policies, urban planning, and sustained demand.

Lower risk of short-term crashes compared to stocks

Stocks: More volatile, with prices fluctuating daily

External factors like economic downturns, company performance, interest rates - and even geopolitical tensions such as trade wars - affect stock prices

For instance, in April 2025, the U.S. imposed steep tariffs on Chinese imports, sparking a retaliatory response and sending shockwaves across global markets

Market crashes can wipe out value overnight, reminding investors of the risks that come with volatility

Verdict: Property wins for stability, while stocks are more volatile but offer higher short-term growth potential.

4. Which one makes you richer?

Property:

Average capital appreciation of 3-5% annually

Rental yields of 2-4% depending on the location and property type

While relatively strong demand plays a role, it's ultimately the well-calibrated government policies that anchor property values and contribute to long-term market stability.

Stocks:

Long-term returns of 7-10% annually, based on global indices like the S&P 500

Dividends provide additional passive income (Singapore REITs, blue-chip stocks)

Stock markets have historically outperformed real estate in the long run

Verdict: Stocks win in terms of overall higher returns, but property offers steady long-term growth with the added benefit of rental income.

5. Can you multiply your returns?

Property: Yes! You can borrow money via a mortgage, allowing you to control a larger asset with less upfront capital

If your property price rises by 10%, your return on investment (ROI) isn't just 10% - it's approximately 30% due to leverage. Let me show you how:

Stocks: Limited leverage unless using margin trading, which is highly risky

Stocks offer limited leverage unless you use margin trading, where you borrow funds to invest more than you have. While this can boost returns, it's highly risky - losses are amplified too, and you could end up owing more than your initial investment.

Verdict: Property wins for leverage, as bank loans help amplify returns with less capital.

6. Which protects your wealth better?

Property: Strong hedge against inflation, particularly in Singapore's context.

With relatively strong demand, limited land supply, and government-backed stability, property values and rental income tend to rise over time. As inflation drives up construction and living costs, real estate becomes more expensive - benefiting existing property owners. Historical data also shows that Singapore's property prices have outpaced inflation by about three times over the past two decades, further reinforcing its resilience.

A property can also double up as a safety net. You can live in it, rent it out for passive income, or even leverage it for refinancing during tough times. Its utility goes beyond paper gains.

Stocks: They have the potential to outpace inflation, but...

Not all companies thrive in high-inflation environments. Rising costs can erode profit margins, and during economic downturns, stock prices may become more volatile. Inflation-sensitive sectors may struggle, making stock performance less predictable.

Verdict: Though both assets offer inflation protection, property stands out as a more stable and effective hedge - backed by tangible value, income potential, and long-term price appreciation.

Now that we've compared property and stocks across key investment factors, let's examine historical performance and real-life data to determine which investment has truly created more wealth over time.

Blue line: Private property, Red line: HDB, W: World events

Singapore's property market has shown incredible resilience through major global events like the 2008 financial meltdown and the 2020 COVID-19 pandemic. While both the HDB and private residential markets experienced short-term dips during these periods, they rebounded strongly - especially the private market, which surged by over 236%, outpacing the 177% growth in the HDB market, which has climbed steadily due to some flats breaching the million-dollar mark. Of course, not everyone holds their property for 20 years - but even over shorter timeframes, property owners have generally enjoyed meaningful capital appreciation.

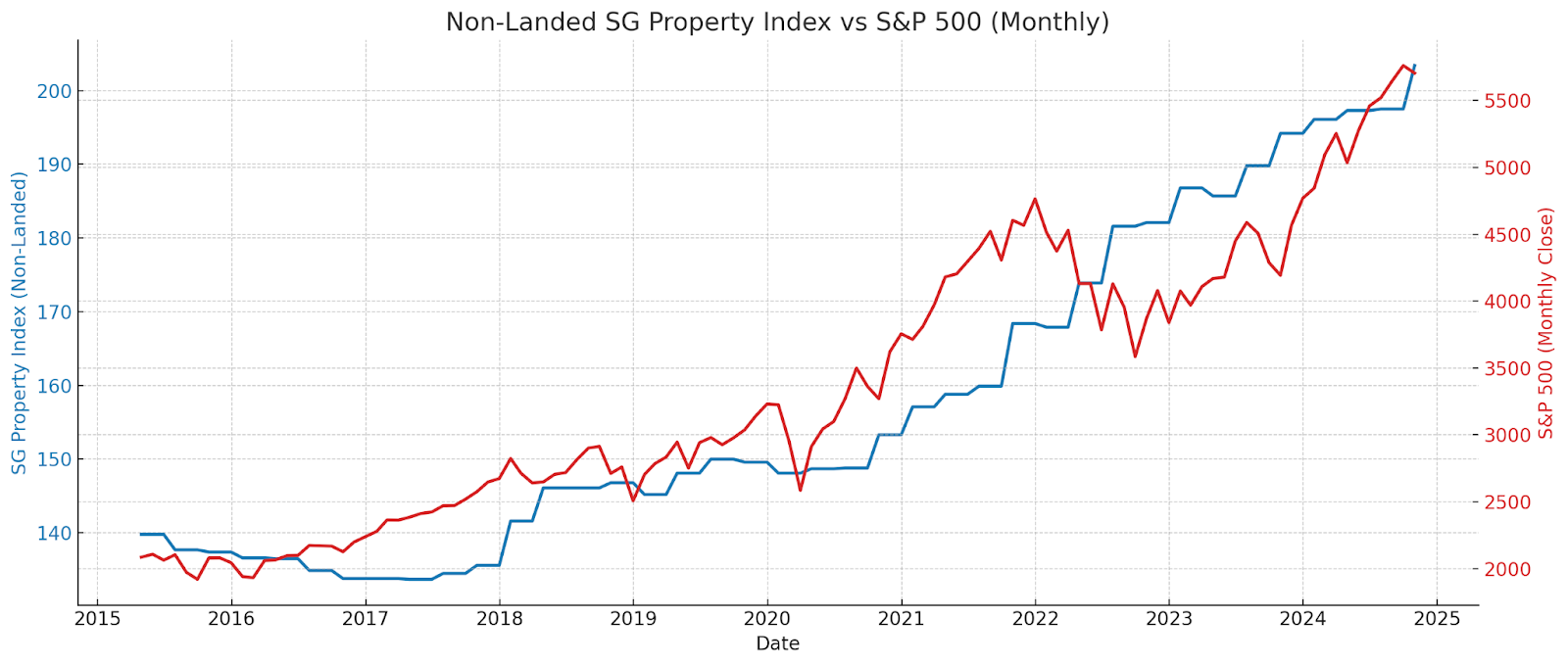

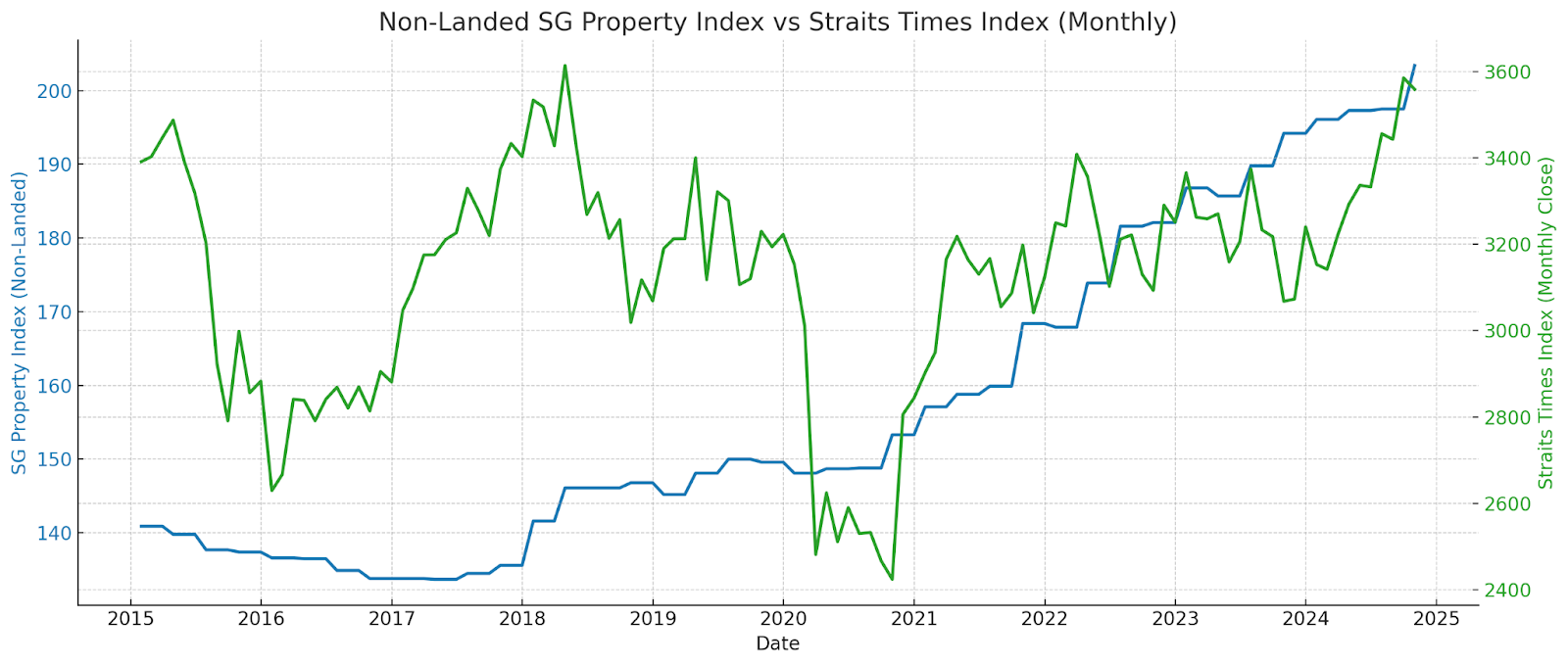

Over the past 20 years, global stock markets - especially the S&P 500 - have delivered exceptional returns, rising by over 360%, fuelled by innovation, tech growth, and investor optimism. In contrast, Singapore's Straits Times Index (STI) has seen more modest gains, rising approximately 45% over the past 20 years. Stocks offer inflation-beating potential, but performance varies significantly depending on geography and market composition.

The S&P 500 may have surged by over 360%, but it came with sharp highs and lows - highlighting the volatility and emotional rollercoaster that often comes with stock investing. In contrast, Singapore's private property market has grown a steady 236%, with far fewer sudden dips.

You won't typically see the same wild swings in real estate here. This long-term strength is underpinned by several key factors: Singapore's limited land supply drives sustained demand and price growth, while strong government regulations help ensure market stability and prevent housing bubbles. With over 90% of Singaporeans owning their homes, real estate remains a natural and trusted path for wealth accumulation.

So before you decide to completely ditch property in favour of the stock market, it's worth asking: what kind of ride are you really signing up for? While equities may offer rapid gains, property provides something just as valuable - stability, rental income, leverage, and the reassurance of a tangible asset.

In a landscape that's constantly shifting, real estate continues to prove itself as a resilient and enduring investment. At the end of the day, building wealth isn't just about high return - it's about having clarity, consistency, and confidence in the path you choose.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.